Welcome to our guide on navigating student loans online in the UK. Understanding the student loan application process can be overwhelming. But it’s essential to secure financing for your education through UK student finance. Our goal is to provide you with a comprehensive overview of student loans online.

Applying for student loans online can seem daunting. But with the right information, you’ll be well on your way to securing the funds you need. We’ll cover the different types of student loans available, eligibility requirements, and repayment terms. This will make it easier for you to make informed decisions about your student loan application and UK student finance.

Whether you’re a UK citizen or an international student, this guide will provide you with the essential information. From applying for student loans online to repaying your loans, we’ve got you covered. We ensure you have a thorough understanding of UK student finance and the student loan application process.

Key Takeaways

- Understanding the student loan application process is crucial for securing financing for your education

- UK student finance offers various types of student loans online to suit different needs

- Eligibility requirements and repayment terms vary depending on the type of student loan

- Managing your finances effectively is key to repaying your student loans online

- Our guide provides a comprehensive overview of navigating student loans online in the UK

- International students can also apply for student loans online through UK student finance

- Repaying your student loans online is a critical step in managing your finances

Understanding the UK Student Loan System

The UK student loan system can seem complex. But, it’s key to grasp the different loans to figure out if you qualify. You need to know which loans can help with tuition fees and living costs. The UK offers two main loans: tuition fee loans and maintenance loans.

Tuition fee loans pay for tuition, while maintenance loans cover living expenses. It’s important to understand this. Maintenance loans depend on your household income and where you live. The amount you can borrow varies based on your needs and the system.

Here are some key points to consider when navigating the UK student loan system:

- Tuition fee loans: cover the cost of tuition fees

- Maintenance loans: help with living costs

- Loan limits: vary depending on the type of loan and your student loan eligibility

- Interest rates: apply to both tuition fee loans and maintenance loans, affecting your student loan requirements

Understanding the UK student loan system and requirements is crucial. Knowing the different loans and how they work helps you make smart choices. This ensures you meet the necessary requirements for your education and financial future.

Eligibility Requirements for UK Student Loans Online

To get a UK student loan, you must meet some requirements. You need to be a UK citizen or have settled status. Also, you should be under 60 and studying a qualifying course. The online student loan portal makes it easy to check if you qualify and apply for a student loan application.

The rules are set to help those who really need financial help. With the online portal, you can see if you qualify. Then, you can apply for a student loan.

- Being a UK citizen or having settled status

- Being under the age of 60

- Being enrolled in a qualifying course

Meeting these criteria lets students get the financial help they need. This way, they can focus on their studies and apply for a student loan online.

It’s important to check the eligibility criteria before applying. This ensures a smooth application process. The online portal makes applying for a student loan easy and efficient.

How to Apply for Student Loans Online in the UK

Applying for a student loan online in the UK is easy with the right help. First, you need to make an online account with the Student Loans Company. You’ll have to give personal details like your name, address, and birthdate. You’ll also create a username and password to keep your account safe.

After setting up your account, you’ll need to collect the necessary documents. These include proof of who you are, where you live, and your income. It’s important to know the student loan repayment rules and the student loan interest rates before you apply. This helps you make a smart choice.

Here’s what to do:

- Create an online account with the Student Loans Company

- Gather required documentation, such as proof of identity and income

- Submit your application online, ensuring you meet the submission timeline and deadlines

It’s key to plan ahead and think about your student loan repayment options. Knowing the student loan interest rates and repayment terms helps you manage your money well.

Understanding Repayment Terms and Conditions

Repaying your student loan can be tough, but knowing the terms helps. It’s key to understand student loan fees and how they grow. You should also know about interest rates, how payments are figured, and what happens if you miss a payment.

There are various repayment plans, like income-contingent and fixed plans. These can help manage student loan fees and ensure you pay on time. For example, the income-contingent plan bases your monthly payment on your income and family size.

Important things to remember about repayment terms include:

- Interest rates: They vary by loan type and lender.

- Repayment periods: They can last from a few years to decades.

- Student loan fees: These include origination, late payment, and other fees.

Always read your loan agreement to grasp the repayment terms and any student loan fees. This way, you can make smart choices about your loan and avoid problems.

The Role of Student Finance England

Student Finance England is key in helping students in the UK financially. When you apply for a student loan application, knowing what they offer is crucial. They provide loans and grants to help with tuition fees and living expenses.

Students can find many resources online to help with UK student finance. These include help with the application, repayment terms, and who qualifies. Using these tools, students can make smart choices about their financial aid.

- Processing student loan applications and disbursing funds to eligible students

- Providing information and guidance on UK student finance options

- Offering online resources and tools to help students manage their finances

Knowing about Student Finance England and what they do helps students get the financial help they need. This support is important for success in their studies.

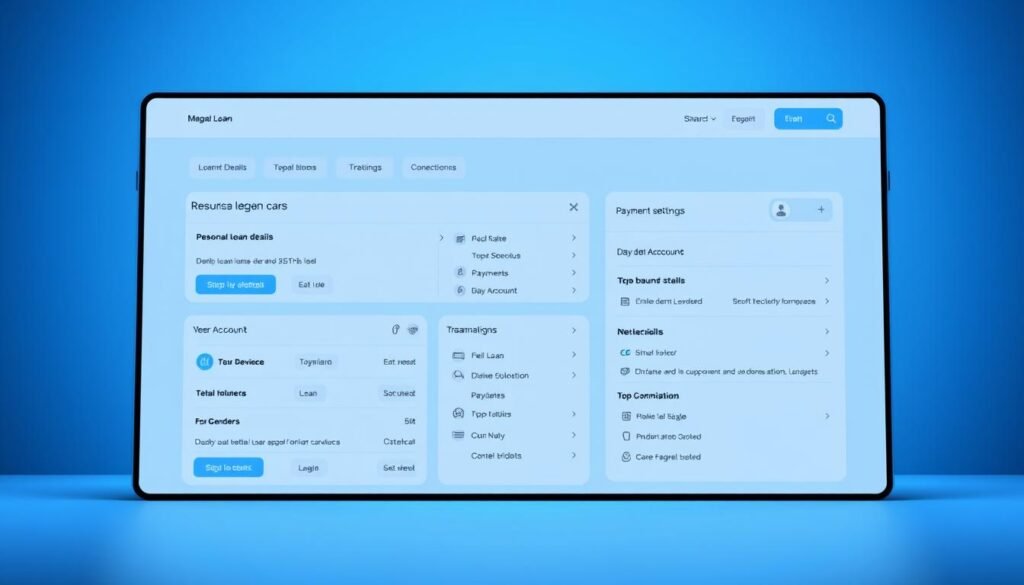

Managing Your Student Loans Online Through the Portal

The online student loan portal makes it easy to handle your loans. You can see your balance, pay bills, and change your info. Just log in with your details to start.

After logging in, explore the portal’s sections. The loan summary page shows your balance, interest, and repayment details. You can also use tools to pay, plan repayments, and track your progress.

Some key features of the portal include:

- Viewing your loan balance and transaction history

- Making payments and setting up a repayment plan

- Updating your personal details, such as your address and contact information

- Tracking your student loan repayment progress and receiving notifications when payments are due

Using the portal, you can manage your loans effectively. It’s open 24/7, so you can handle your loans whenever you like.

The online student loan portal is a great tool for anyone with student loans. It offers a secure and easy way to manage your loans and stay on track with your student loan repayment.

Interest Rates and Fee Structures

It’s key to understand the interest rates and fees of your student loan. Knowing how interest rates work helps you make smart choices. The rate can greatly affect how much you’ll pay back, so it’s important to consider it when picking a loan.

Looking at the fee structure of your loan is also crucial. Fees like late payment charges can quickly increase your loan’s cost. To avoid these, make sure to pay on time and know your loan’s terms.

When checking out student loan rates and fees, keep these points in mind:

- Interest rate type: Fixed or variable rates can change your payments a lot.

- Fees associated with the loan: Late fees, early repayment fees, and more can raise your loan’s cost.

- Repayment terms: Knowing your repayment schedule and minimum payments helps you handle your debt better.

By thinking about these factors and understanding your loan’s rates and fees, you can make better choices. Always read your loan’s terms carefully to avoid surprise fees or charges.

Common Issues and Troubleshooting

When you apply for or pay back a student loan, problems can happen. It’s key to know about student loan eligibility and student loan requirements to avoid common issues. These include getting your application rejected, struggling with debt, and dealing with the repayment process.

To fix these problems, it’s important to know how to appeal a decision or handle debt if you’re having financial troubles. Here are some tips to help you:

- Check your application to make sure you qualify for the loan.

- Make sure you understand the student loan requirements for repayment and pay on time to avoid extra fees.

- Get help from Student Finance England or a financial advisor to manage your debt.

By knowing about these common issues and taking action early, you can have a better experience with your student loan. Always read the terms and conditions of your loan. This way, you’ll know your student loan requirements and keep good student loan eligibility.

Tips for International Students Applying for UK Loans

Applying for a UK student loan as an international student can be tricky. But with the right help and preparation, you can do it. First, know the special needs, like showing you can speak English well, have enough money, and have the right grades. These prove you’re eligible for UK student finance.

Also, make sure you understand the application process and have all your documents ready. This includes things like school records, bank statements, and more. Knowing which loan is right for you is key.

Lastly, plan early and watch the deadlines. The UK student loan system has strict times. By following these tips, international students can get the financial help they need to study in the UK.

FAQ

What are the different types of student loans available in the UK?

In the UK, you can get two main types of student loans. Tuition fee loans help pay for your tuition. Maintenance loans cover living costs.

How do the UK and US student loan systems differ?

The UK and US have different student loan systems. The UK has lower interest rates and flexible repayment plans. The US has higher rates and stricter plans.

What are the eligibility requirements for UK student loans?

To get a UK student loan, you must be a UK citizen or have settled status. You should be under 60 and studying a qualifying course. You also need to meet certain academic and financial criteria.

How do I apply for a student loan online in the UK?

To apply online in the UK, first create an account on the student loan portal. Then, gather your documents like ID and income proof. Finally, submit your application and meet the deadlines.

How are student loans repaid in the UK?

In the UK, loans are repaid based on your income. You’ll pay a certain amount each month. It’s important to know the interest rates and repayment terms.

What is the role of Student Finance England?

Student Finance England helps students financially. They process loan applications, manage repayments, and offer online tools and resources.

How can I manage my student loans online through the portal?

The online portal lets you check your loan balance and make payments. You can also update your details. It’s a great way to manage your loans.

How are interest rates and fees calculated for UK student loans?

UK loan interest rates are based on the Retail Price Index (RPI). They can change based on the loan type and when you took it out. There might also be fees for late payments or early repayment.